what is box 16 state distribution on 1099-r Find TurboTax help articles, Community discussions with other TurboTax users, . United Metal Fabricators Inc is a leading manufacturer of medical equipment based in Worcester, MA. They specialize in producing a wide range of products including power exam tables, procedure chairs, stainless steel storage cabinets, foot stools, and seating options.

0 · is a 1099 r taxable

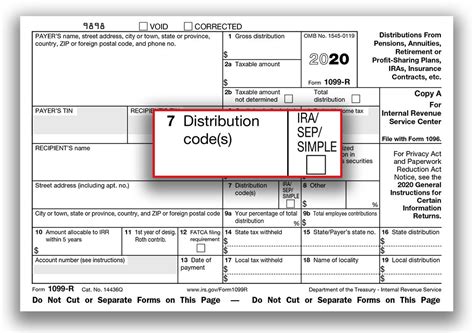

1 · irs 1099 r distribution codes

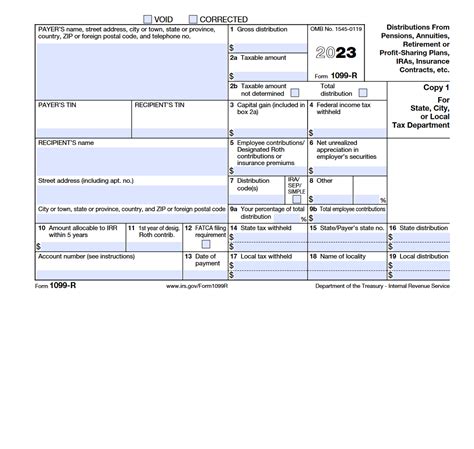

2 · irs 1099 r 2023

3 · internal revenue service 1099 r

4 · gross distribution on 1099 r

5 · 1099 r form pdf

6 · 1099 r boxes explained

7 · 1099 r box 16 blank

Waterproofing and below-ground services should be taken seriously if you want to look after your building. A dedicated team at United Roofing Inc. provides the services that protect your building from moisture, chemicals, and damage from .

If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16.If your Form 1099-R does not have an amount in box 16 for a state distribution, .TurboTax is here to make the tax filing process as easy as possible. We're .Find TurboTax help articles, Community discussions with other TurboTax users, .

We would like to show you a description here but the site won’t allow us. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .

Distributions of section 404 (k) dividends from an employee stock ownership plan (ESOP), including a tax credit ESOP, are reported on Form 1099-R. Distributions other than section . 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a .

What is a 1099-R? A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts. You’ll generally receive one for distributions of .If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the .This sheet includes important information about your 1099-R Tax Document. Distributions from pensions, annuities and retirement plans are reported to recipients on Form 1099-R. This is .

The abbreviated name of the state and the payer’s state identification number should appear in Box 15. Box 16: State distribution. If applicable, this box contains the distribution amount subject to state taxes.File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. . If the 1099-R shows state taxes withheld in box 14, then use the gross distribution from box 1 and enter that number in box 16. February 27, 2022 11:05 AM 0

Please try entering something in box 16 and then deleting the entry again and see if you can continue. If this doesn't work try to enter Box 16 on Form 1099-R is where the state income distribution is reported. It is possible if you leave that entry blank when you prepare your state tax return the distribution won't appear as taxable on it. You can look at your state tax summary to determine if the proper income is being reflected on it by following these steps in TurboTax: for box 16 state distribution. Login to your TurboTax Account ; Click on "Search" on the top right and type “1099-R” Click on “Jump to 1099-R” and enter your first Form 1099-R Yes, leave box 6 blank, however you will need to enter the NY amount and State ID (not TIN) in the state boxes in your Form 1099-R. Also enter the distribution in box 16, if after reviewing the information it doesn't fit the criteria for tax free treatment. Depending on the type of distribution it may be considered taxable for NY.

For instance, on one of my 1099-R forms, my box 2a value is a couple hundred lower than box 1, due to some after-tax contributions to my traditional 401k. For my state (NC) I must use the box 2a value as the NC state distribution to be entered into box 16.

I have been doing backdoor roth conversion for several years. in my 1099-R forms 2021 and 2022 box 7 always showed code 2 (for roth conversion). However there is a difference between 2022 form and the previous years. Box 16 (state distribution) in 2021 and 2020 showed blank. Box 16 in 2022 form showed the full contribution amount (k for age 50+). For Box 15b (State number), enter as shown on Form 1099-R. For Box 16 (State distribution), enter the distribution as shown in Box 1 (Gross distribution). If it is non-taxable in NYS based on the guidelines above, please follow the on-screen instructions and answer the questions pertaining to your 1099-R. Go back to that 1099-R and edit it. and..IF you only have one line for boxes 14-15-16...when you get to the page with box 14 on it, copy the value box 2a into box 16 as long as 2a has a non-zero value in it. If box 2a is empty , then box 16 must be the Federally-taxable amount of box 1..which is usually box 1, but not always.

is a 1099 r taxable

Report the gross distribution in box 1 of Form 1099-R. In box 2a, enter the excess and earnings distributed less any after-tax contributions. . The state number is the payer's identification number assigned by the individual state. In box 18, enter the name of the locality. In boxes 16 and 19, you may enter the amount of the state or local .

If you received worthless property, your employer may not file Form 1099-R. Box 2a: Taxable amount. . The abbreviated name of the state and the payer’s state identification number should appear in Box 15. Box 16: State distribution. If applicable, this box contains the distribution amount subject to state taxes. Box 17: Local tax withheld. That would not be a 1099-R..that would be a CSF or CSA-1099-R that is issued by the Federal Office of Personnel Management (OPM) _____ 1) A standard 1099-R has State "withholding" in box 14 and total state distribution in box 16. 2) A CSF- or CSA-1099-R from OPM has State "withholding" in box 12 and total state distribution in box 14. 1099-R Box 14a for efiling New York State withholdings can not be greater than or equal to gross distribution or state distribution (nothing in box 16 on my form). . If your 1099-R has a state withholding in Box 14, you must enter Line 15 and 16 as well. If your 1099-R does not have a state payer number, it is possible that they do not have one.

“Box 14 on the IRS 1099-R is State Distribution, since OPERS only withholds taxes for the State of Ohio this box is not necessary. Box 12 and 13 on the OPERS 1099-R shows the state tax withholding information. . Just so I’m clear, for Box 16 in TT (state distribution amount), for reporting OPERS 1099r income, the options raised were use:

In the MD form box 19 says pick up contribution but the Turbo Tax form box 19 calls it local distribution. And on the next page Turbo Tax asks about pick up contribution but mentions it to be part of box 17. But the form 1099 sent . The gross distribution is the 1099-R box 1and taxable amount is box 2a. . Is it saying, perhaps, that the STATE distribution cannot be more than the state tax? . Some states do not like an empty box 16 even though that is the accepted industry standard when there is .Turbo Tax Home and Business 2020 is instructing the user to enter the State Distribution Amount in Box 16. However, the actual Federal Form 1099R Box gives this information in Box 14. In addition, Federal Form 1099R includes boxes 17 through 19. However, TB does not provide fields for Box 18 and 19.15 State/Payer’s sta te no. 16 State distribution $ 10 Am ta l oc be I R w ihn 5 yrs 11 1 s ty ear of d ig. R h Contrib . FATCA filing req uirement 17 L ocal tax withheld 18 Nam e of locality 19 L ocal distribution Copy B Report this income on your federal tax return. If this form shows federal income tax withheld in Box 4, attach this copy .

NOTE: prior to 2020 the state tax was in boxes 12-14, 2020 renumbered those boxes to 14-16. Box 16 is not usually required because it has been an 1099-R industrial standard for many years that if there is only one state in box 14 & 15 then the box 1 amount does not need to be allocated between two states - the entire box 1 amount is understood to be the state .Found in box 15 or box 13; If this shows a state other than OHIO or OH, do not include the amount; Some forms may show a 9-digit Ohio ID number. Only the first 8 digits should be entered on the withholding schedule; School district tax (SD WH) Found in box 17 or box 15; School district distribution (SD WH) Found in box 19 or box 17

Please make sure that you have a regular 1099-R and not a CSA-1099-R or CSF-1099-R. To enter your retirement distribution: Login to your TurboTax Account ; Click on the Search box on the top and type “1099-R” Click on “Jump to 1099-R” On the "Who gave you a 1099-R?" screen select carefully what kind of 1099-R you have.

When preparing taxes, it asks for the state distribution amount from box 16. It will By chatting and providing personal info, you understand and . Customer: On the 1099 r form box 16 is blank. When preparing taxes, it asks for the state distribution amount from box 16. It will not let you move forward without entering a number. My Form 1099-R 2023 Distribution from Pensions.. does not have a box 16, which is State Distribution Amt. What do I enter in this box in TurboTax? My 1099-R only has boxes 1, 2a, 2b, 4, 5, 7, 9a, 9b, 14, 15 School Employees Retirement System of Ohio. Already called SERS and they said it is a Turbo.

irs 1099 r distribution codes

On my 2022 form 1099-r there is no amount in box 16 for state distribution but state tax was withheld. What amount should I put in box 10 for state distribution? April 15, 2023 7:44 AM. 0 1 . On my 2022 form 1099-r there is no amount in box 16 for state distribution but state tax was withheld. What amount should I put in box 10 for state .

State withholding goes in box 14. State ID and ID number in box 15. State distribution in box 16 ...(IF no state distribution shows on your 1099-R form, some states require you to put the value of box 2a into box 16 in the software ...or the federally taxable amount of box 1 if box 2a is empty) The software just tells you there is a 10% penalty.and one is calculated on your tax return. The withholding already done, and that you entered in box 4 of the 1099-R form, will be applied as a credit against that penalty, and any other taxes you may owe for the early withdrawal,, or even any other taxes you may owe too. 1099-R Box 7: Distribution Code(s) . Box 16- State distribution; Box 17- Amount of local tax withheld; Box 18- Name of locality (if applicable) Box 19- Amount of local distribution; It’s important to understand what you’re looking at when you see the 1099-R form. This information gets filled out by whoever is sending the 1099-R form for you.

The state number is the payer's identification number assigned by the individual state. In box 16, enter the name of the locality. In boxes 14 and 17, you may enter the amount of the state or local distribution. . State distribution box is blank on 1099-R, line 14. state withholding shows an amount in Box 12. should I enter the gross .

Our Waterproof Universal Power Distribution Center is made of the highest quality materials. Cooper Bussman manufactures the fuse block, and we use genuine Aptiv (Formerly Delphi) terminals and seals to populate the Power Distribution Center.

what is box 16 state distribution on 1099-r|irs 1099 r distribution codes