1099-r box 7 distribution code f Distributions to a domestic abuse victim. For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to . The FreshJet FJX Mechanical Air Distribution Box (ADB) is easy to use, simply twist a knob to set the temperature and fan speed to welcome refreshing air. State-of-the-art construction delivers superb front and back airflow allowing you to peacefully reset after a long day of exploration.

0 · what does code 7d mean

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099r box 7 code 8

5 · 1099 r distribution code m2

6 · 1099 r distribution code e

7 · 1099 distribution code 7d

At its core, a CNC woodworking machine is a computer-controlled device that uses specialized software to precisely cut, shape, and carve wood materials. Unlike traditional woodworking tools that require manual manipulation, a CNC machine operates through programmed instructions, allowing for unmatched precision, repeatability, and efficiency.

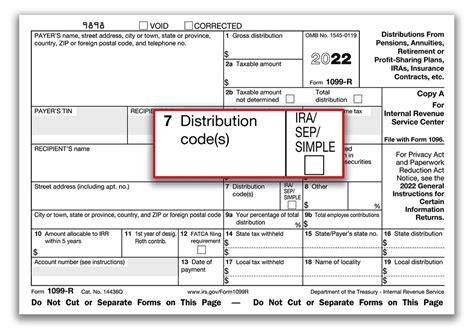

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .Distributions to a domestic abuse victim. For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

Distributions to a domestic abuse victim. For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

what does code 7d mean

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).Distributions to a domestic abuse victim. For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

nec code for junction boxes in attic

nema 3 junction box grounding lug

The Central Junction Box is the fuse panel under the dash. It is important for everyone to know this term, because even the lowly Haynes manual (with it's crappy wire diagrams) calls it a Central Junction Box.

1099-r box 7 distribution code f|1099 r distribution code m2