irs form 1099-r box 7 distribution codes If a rollover contribution is made to a traditional or Roth IRA that is later . The wiring for a 30 amp breaker must be able to handle the maximum current load without overheating or causing a fire. This typically requires the use of a heavier gauge wire, such as 10 AWG or 8 AWG, depending on the specific requirements of the installation.

0 · irs distribution code 7 meaning

1 · irs 1099 distribution codes

2 · irs 1099 box 7 codes

3 · distribution code 7 normal

4 · distribution code 7 non disability

5 · 7d distribution code 1099

6 · 1099 box 7 code m

7 · 1099 4 box 7 codes

The NEC has outlined specific requirements for junction boxes to ensure the safety and proper installation of electrical wiring systems. Here are some of the requirements that your business will need to follow.

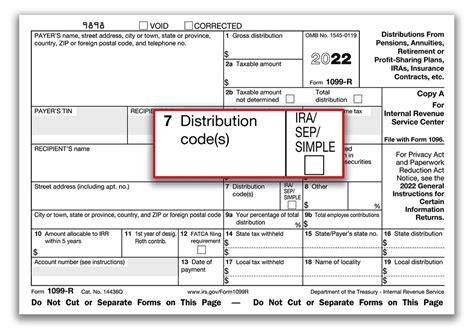

Use Table 1 to determine the appropriate code(s) to enter in box 7 for any amounts reported on Form 1099-R. Read the codes carefully and enter them accurately because the IRS uses the codes to help determine whether the recipient has properly reported the distribution. If the .File Form 1099-R for each person to whom you have made a designated distribution .If a rollover contribution is made to a traditional or Roth IRA that is later .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after .

Form 1099-R, Box 7 codes. The following are the instructions for the 1099-R, Box 7 data entry and what each code means. Codes. 8: Per IRS instructions, distributions with code. 8. that are not . The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth .

Box 7 is the distribution code, this describes the type of distribution the taxpayer took as known by the payer. The code will help to determine the taxability of the distribution. If the payer knows the distribution was a loan or a rollover, the .

irs distribution code 7 meaning

amount will be shown in this box and code W will be shown in box 7. You need not report these amounts on your tax return. If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable death benefits that is taxable in part. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non-taxable amount. Is this code G - Given in Box 7 Correct or should it be a different code like B ( rollover to Roth plan ?).

falcon eco nxt stainless steel lunch box

1099-R Codes for Box 7. Haga clic para español. Revised 12/2018. Box 7 Code. . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report . Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D .amount will be shown in this box and code W will be shown in box 7. You need not report these amounts on your tax return. If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable death benefits that is taxable in part.

1099-R Codes for Box 7. Haga clic para español. Revised 09/2019. Box 7 Code. . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report .1099-R Codes for Box 7. Haga clic para español. Revised 01/2024. Box 7 Code. . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 591/2; (b) for a Roth IRA conversion if the participant is at least age 591/2; and (c) to report a . Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as n.

irs 1099 distribution codes

Use Code 7 in box 7 for reporting military pensions or . codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and distributions from a section 457(b) plan maintained by a state . plan distributions, later, for information on distribution codes. Nonqualified plans. Report any reportable . A common compliance mistake occurs when financial organizations use the incorrect distribution code in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. IRA owners and qualified retirement plan (QRP) participants who take distributions during a given .

May be eligible for the 10-year tax option method of computing the tax on a lump sum distribution. (See the instructions for Form 4972). 4, 7: B: Designated Roth account distribution. (If an amount is also reported in box 10, see the instructions for Form 5329 and Publication 575.) 1, 2, 4, 7, 8, G, L, M, P, U: C: Reportable death benefits .amount will be shown in this box and code W will be shown in box 7. You need not report these amounts on your tax return. If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable death benefits that is taxable in part.

Guide to Distribution Codes. Box 14a. Repayments. Box 14b. Code. RMDs. Box 1. . Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code . (ESOP), including a tax credit ESOP, are reported on Form 1099-R. Distributions other than section 404(k)

You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. . That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. View solution in original post June 3, 2019 12:55 PM. 0 9 3,877 Reply. . Nondisability you enter a code 7 in box 7 of the TurboTax form . The form provides information to the recipient and the IRS about the distributions made, which you would also use to report income on your individual tax return. Box 7 of IRS Form 1099-R is used to indicate the .

IRA Distributions enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J or . the tax, enter Code J in box 7; if the earnings are not subject to IRAs other than Roth IRAs. Distributions from any individual that tax, enter Codes T and 8. . Yes, the regular distribution of ,000 reported on the 2022 Form 1099-R code J will be entered on the 2022 tax return. Yes, the 2022 Form 1099-R with codes P and J for the 2021 excess contribution plus earnings will be entered on the 2021 tax return.

amount will be shown in this box and code W will be shown in box 7. You need not report these amounts on your tax return. If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable death benefits that is taxable in part.

irs 1099 box 7 codes

amount will be shown in this box and code W will be shown in box 7. You need not report these amounts on your tax return. If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable death benefits that is taxable in part. Content Submitted By Ascensus. One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Consider the following .

Internal Revenue Service Instructions for Forms 1099-R and 5498 Section references are to the Internal Revenue Code. What's New for 2001? Form 1099-R. Distribution codes for box 7 are in a chart format, Guide to Distribution Codes , on pages R-9 and R-10. Also, the following changes were made to the following distribution codes reported in box 7:For information about distribution codes in Box 7 of Form 1099-R, go to the IRS Instructions or find the information in your TaxAct return: . Go to the IRS Instructions for Forms 1099-R and 5498, page 15, to view Table 1. Guide to Distribution Codes. Find the information in your TaxAct return (if you need help accessing Form 1099-R, .

Check the box under Rollover or Disability on Form 1099-R, and enter the amount rolled over. Trustee to trustee transfer isn’t considered a prior rollover. If more than one rollover from an IRA in the 12-month period, return is Out of Scope. • If this wasn’t rolled over, a 10% additional tax will be applied unless the taxpayer qualifies

See details below. Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. Besides, it will also be reported on a Form 5498 "IRA Contribution Information" where box 11 and 12 will be . Distribution Code Table entries on Form 1099 on Box 7. amounts reported on Form 1099-R. Description of Codes in Box 7. 15 Tax Calculators . for information on distributions that may be subject to the 10% additional tax; A distribution from a qualified retirement plan after separation from service in or after the year the participant has .2020 1099-R Box 7 Distribution Codes: 1 (1) Early distribution, no known exception . May be eligible for 10-year tax option. (See Form 4972.) B: Designated Roth account distribution. (If an amount is also reported in box 10,see the Instructions for Form 5329 and Publication 575.) C:

faithfull tbb16 metal barn tool box 42 cm

You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R. Who completes Form 1099-R?

fancy oem metal enclosure

illustrations on how to wire switches and lights using junction box

irs form 1099-r box 7 distribution codes|distribution code 7 normal